Chilalo

Graphite Project

Development ready

Chilalo Graphite Project in Tanzania

Chilalo Project

High-margin, low capex

BTR strategic partnership

Transformational offtake, funding and downstream collaboration

Battery suitability

Premium quality CSPG produced from fines

Vertically integrated strategy

Accelerated and de-risked partnership model with proven technology

| Flake Size Price Premium | Evolution Product Flake Size | |||

|---|---|---|---|---|

| 10% +32 | 21% +50 mesh | 27% +80 mesh | 6% +100 | 36% -100 mesh |

| 58% +80 mesh | ||||

| Binding Offtake with YXGC | Offtake with BTR New Material Group | |||

Large, High-Grade Mineral Resource

Potential for Multi-decade mine life

New discoveries provide scope to define additional near-surface deposits to grow the mineral resource/ore reserve.

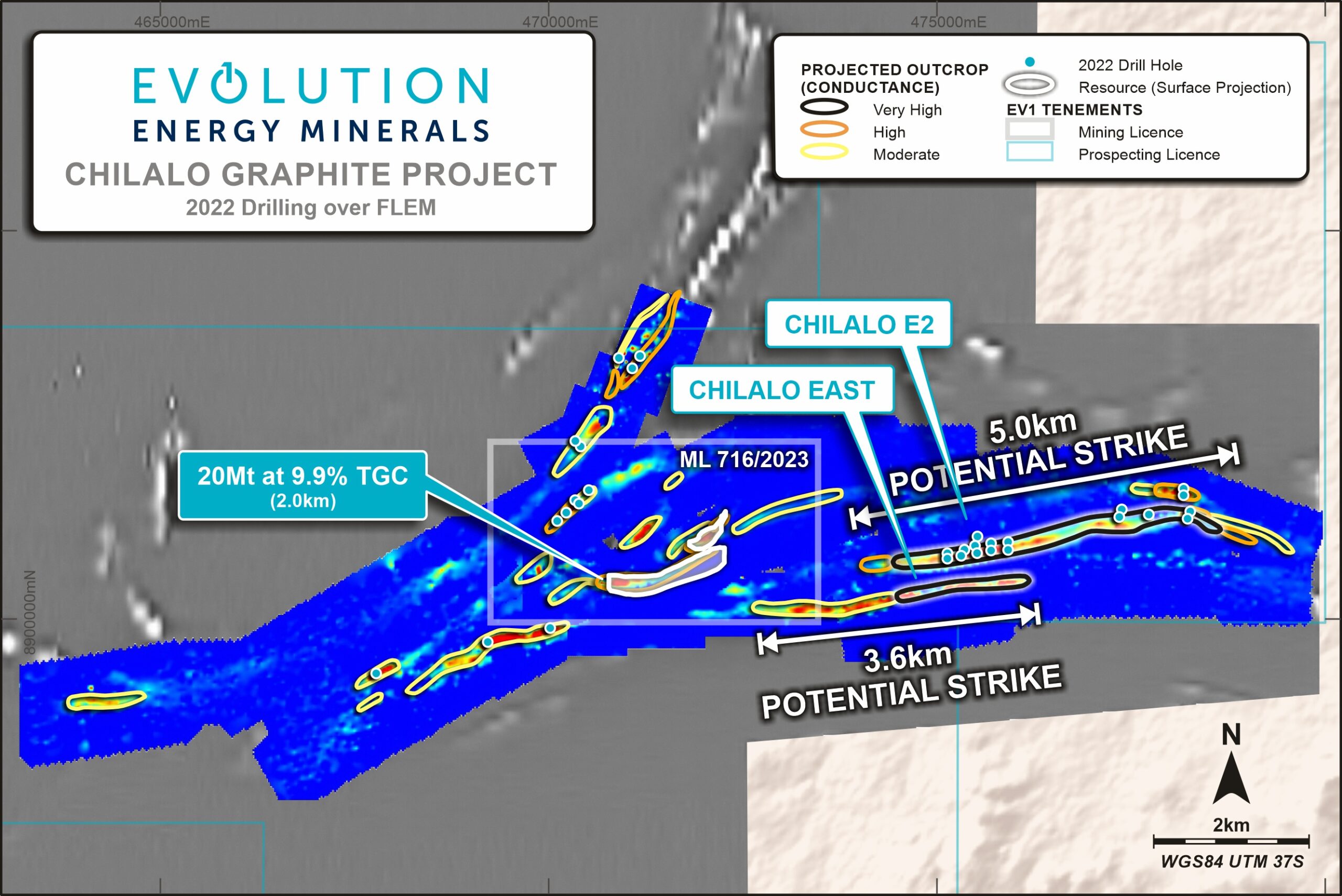

In early 2023, Evolution discovered two new high-grade mineralised zones – Chilalo East and Chilalo E2. High-grade mineralisation at Chilalo East has been defined over 1.6km out of a potential 3.5km strike length indicated by the high-conductance electromagnetic conductor.

At Chilalo E2, located to the east of Chilalo Mining Licence and parallel to the north of Chilalo East, 1.1km out of a potential 5km strike has been tested so far with mineralisation open to the east and west.

Mineral Resource Estimate

| Domain | Classification | Tonnes (Mt) | Grade TGC% | Contained Graphite (kt) |

|---|---|---|---|---|

| High-Grade Zone | Indicated | 10.3 | 10.5 | 1082 |

| Inferred | 9.8 | 9.3 | 908 | |

| Total High-grade Mineral Resource | Indicated & Inferred | 20.1 | 9.9 | 1,991 |

| Low-grade zone | Inferred | 47.3 | 3.5 | 1,677 |

| Total Mineral Resource | Indicated & Inferred | 67.3 | 5.4 | 3,667 |

Ore Reserves

| Domain | Classification | Tonnes (Mt) | Grade TGC% | Contained Graphite (kt) |

|---|---|---|---|---|

| Chilalo | Proved | - | - | - |

| Probable | 8.0 | 10.5 | 836 | |

| Total Ore Reserve | Total | 8.0 | 10.5 | 836 |

Increased mineral resource = Increased mine life & NPV

33km of high-conductance targets only partially drilled

| Physicals | Unit | DFS Outcomes |

|---|---|---|

| Mine life | Years | 17 |

| Total plant feed | Mt | 8.3 |

| Annual plant feed | ktpa | 500 |

| Average head grade | TGC % | 10.6% |

| Average graphite concentrate production | ktpa | 52 |

| Steady state expandable graphite sales | ktpa | 12 |

| Steady state micronised graphite sales | ktpa | 8 |

| Project Financials | Unit | DFS Outcomes |

|---|---|---|

| NPV8 (post-tax) | US$M | 338 |

| IRR (post-tax) | % | 32% |

| Payback period (post-tax) | years | 3.3 |

| Pre-production capital cost (incl. contingency) | US$M | 119.7 |

| Average annual EBITDA | US$M | 82 |

| Average sales price (FOB) per tonne of concentrate | US$ | 1,614 |

| Operating costs per tonne of concentrate | US$ | 773 |

| Operating margin per tonne of concentrate | US$ | 841 |

- Results of 2023 DFS

Product Quality

Globally Significant Flake Size

| Physicals | Mass Dist. % | Grade | Markets (Concentrate) | Market Downstream |

|---|---|---|---|---|

| +32 Mesh | 10.5 | 95-97 | Expandable graphite precursor flake (foils, fire retardants) drilling fluids, engineered products | Expandable graphite (foils, fire retardants) Expanded graphite (alkaline batteries) |

| +50 Mesh | 20.6 | 95-97 | ||

| +80 Mesh | 26.9 | 95-97 | ||

| +100 Mesh | 6.3 | 95-97 | ||

| -100 Mesh | 35.8 | 95-97 | Micronised & battery graphite precursor, traditional | Micronised graphite, Coated spherical graphite |

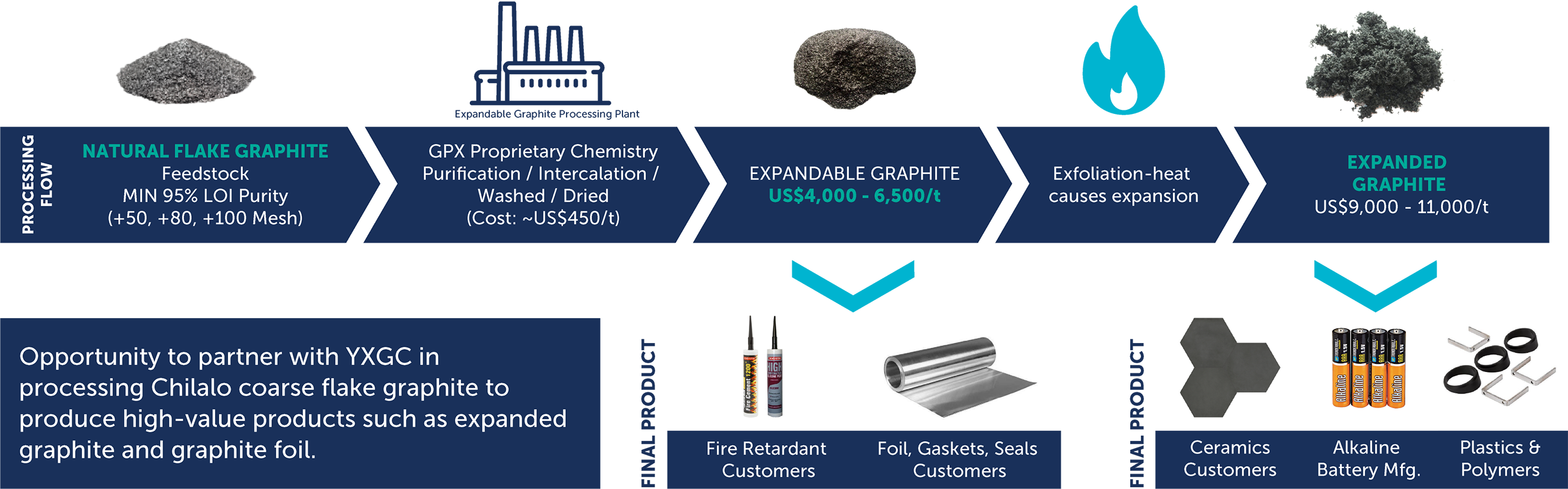

Expandable

Graphite Strategy

Toll-treating Chilalo coarse flake into high-value products

Fines

Graphite Strategy

Enhancing margins on fines

Evolution has entered into agreements with BTR that provide an opportunity for the Company to position itself as a vertically integrated producer of lithium-ion battery anode materials using fine flake graphite from the Chilalo Graphite Project.

BTR is the global leader in the manufacture of battery anode materials accounting for approximately 26% of global market share. BTR is also the world’s third largest producer of cathode materials. In addition, BTR has substantial capability in research and development which ensures it remains at the forefront of lithium-ion battery technology advancements.

BTR and Evolution have signed an MOU outlining the indicative terms for the parties to form a downstream processing collaboration for the manufacture of battery anode materials, with an initial focus on North America.

On establishment of a joint downstream processing facility, Evolution would supply fine flake graphite from Chilalo to a downstream facility.